The Metter City Council is slated to consider making a donation to a private cause which would violate the Georgia Constitution.

At issue is the Memory Lane Park situated next to the Metter Police Department on E. Lillian Street in Metter. The park is a community effort to create a historical and interpretive park honoring Metter’s residents, featuring memorial walls and benches.

Slated for discussion on Monday’s council meeting agenda is a consideration of a motion to approve a request to consider “to contribute $10,000 to Phase I of the Memory Lane Park on E. Lillian Street.” According to the city council agenda, the project is $155,000. The agenda also states that “the committee” has raised $107,000 and they’re subsequently asking the city to chip in $10,000.

Council History on Memory Lane Park

The project came before council back in June 2022 when Wendell Summerlin asked for support from city council in creating the park on city property and assigning a room inside the police department to serve as a museum for school memorabilia. According to the meeting minutes:

Mayor Boyd informed Mr. Summerlin that Archway drew up plans for a park to be located on the old school property which is now city property. He said he would like for Mr. Summerlin to get with the Downtown Development Authority and work together to develop this property. Mayor Boyd said he would also love to see a museum.

City Manager Carter Crawford told Mr. Summerlin that the city would be in touch with him to explore this further.

No vote was taken by the city council. An extensive review of city council meeting minutes for the remainder of 2022, in 2023, or before June 10, 2024 when Mayor Boyd announced the groundbreaking of the park, no vote was ever taken by city council regarding the establishment of the park or an operating agreement between a committee and the city. “That is an effort that has some momentum behind it. All the council are invited to participate,” the June 10 meeting minutes said of the groundbreaking.

“Committee” & Nonprofit

While the park itself is on city property, the committee set to receive the funds is a private entity. The members of the committee are self-appointed and are not operating at the direction of the city. There is no formal agreement between ‘the committee’ and the City of Metter. According to an article published by The Metter Advertiser, the initiative was launched by former Metter residents, one who now lives in Atlanta and another who lives in Macon.

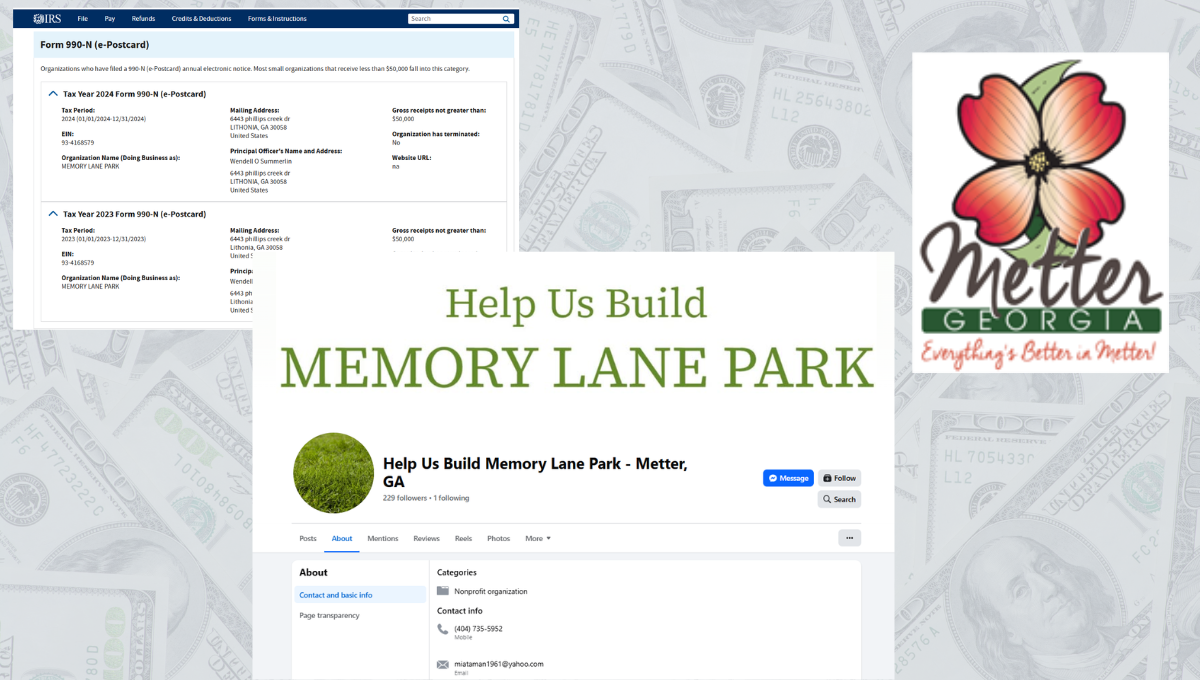

Further, while the Facebook page ‘Help Us Build Memory Lane Park – Metter, GA’ says the entity is a ‘Nonprofit Organization,’ neither the social media page nor the website for the project, which lists brick purchase prices and accepts donations, list any 501(c)(3) tax exemption information.

The 501(c)(3) entity – Memory Lane Park Corp and assigned to Wendell Summerlin.- is listed on both the Georgia Secretary of State’s website and the IRS website as a domestic nonprofit out of Stonecrest and Lithonia. It was established in October 2023 – more than 15 months after it first went before council for a partnership. It did not obtain tax exempt status from the IRS until November 28, 2023 but was given retroactive exemption back to October 23, 2023. According to the Form 990 filed online, the entity raised less than $50,000 in both 2023 and 2024. The contact information for the committee is a yahoo email address.

Issues with Donation

The reason that the donation would present constitutional concerns is multifaceted:

- The entity receiving the funds is a private entity. Government entities are strictly prohibited from donating to private entities and non-profits because it creates an issue with equality – one nonprofit receives donations while others do not.

- The “committee” as referred to by the city was not appointed by the city council and has no connection to the city.

- There is no operating agreement between “the committee” and the city to even establish what the city stands to receive in exchange for the funds.

- There was never a vote by the city council to approve any of the previous steps in the park process.

- There is no mechanism for accounting and auditing standards or with regard to how the funds are used. Further, the agenda item offers no specificity for the $10,000. It would simply be awarded to the entity with no oversight and to use as the self-appointed committee members see fit.

Combined, these issues present a Gratuities Clause concern under the Georgia Constitution.

What is the Gratuities Clause?

The Gratuities Clause is a section in the Georgia Constitution (See Article III, Section VI Paragraph VI) which prohibits the General Assembly from using tax dollars or state property to donate, offer a gratuity (a gift), or forgive a debt or other obligation of a private entity or individual when there is no substantial benefit to the entity. (emphasis added)

The Georgia Supreme Court extended the Gratuities Clause to cities, counties, and school boards decades ago and the Georgia Attorney General has echoed the position for years, time and time again erring on the side of the state constitution.

Under Georgia law, the Gratuities Clause specifically defines ‘substantial benefit’ exclusions as:

- Monetary consideration (like receiving monetary benefit in return for a product or service)

- Instances where the ‘substantial benefits’ are received in return…Privatization of services (See Smith et. Al v. Board of Commissioners of Hall County and the Op. Atty Gen. 70-28) [in these instances, distinct contracts for services exist]

- Reduced administrative burden (Op. Atty General 73-145)

- Purely charitable purposes as defined by the IRS code and includes things like advancement of religion, relief of the poor (See Ga Constitution Article XI Sec II Para VIII)

- Public welfare (like the state offering unemployment seminars for free or county hospital care for the poor (the authority to make charitable contributions must be specifically granted by the General Assembly in a general statute)

- Direct benefit to the public which also takes into account the benefit the donating local government entity is receiving in return (Op. Att’y Gen.81-17)

The request for funds also comes on the heels of a tax increase for Metter citizens and a statement by council members ahead of the most recent election that the city was facing a cash flow problem.

The Metter City Council meeting is scheduled for Monday, December 8 at 5:00 p.m.